Market Finds Its Footing in Metals and Moderation

Record precious-metal prices did most of the lifting for local equities, helped by contained inflation and a steadier outlook for interest rates.

SOUTH AFRICAN FINANCIAL AND ECONOMIC NEWS

This week’s local developments ranged from a clearer inflation and interest-rate outlook, steady power system performance and the opening of budget consultations, to contained year-end price pressures and a major JSE delisting reshaping the local equity landscape.

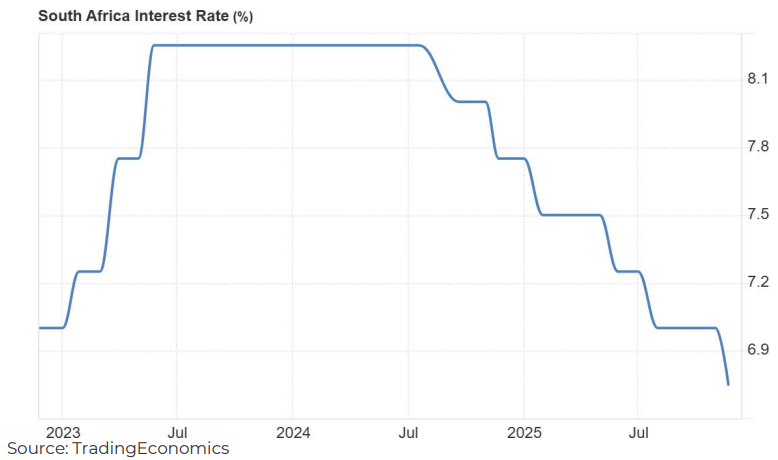

Reserve Bank keeps easing bias in place

At the World Economic Forum in Davos, the South African Reserve Bank governor said inflation is on course to meet the country’s new 3% target during 2026, with price pressures broadly stable across categories. The Bank’s projections put 2025 inflation at 3.2% to 3.4% and the 2026 average at about 3.6%. With the policy rate at 6.75%, the Bank’s model still allows for two further 25 basis point cuts during 2026, with the next Monetary Policy Committee meeting due the following week. A clearer path to lower borrowing costs may support government bonds and ratesensitive equities, while reducing debt-service strain for households and companies.

Power supply holds steady despite Koeberg transmission fault

Eskom said the national power system remained stable into the week, citing generation recovery gains and a long run without widespread load-shedding interruptions. On 20 January, both units at the Koeberg nuclear station were temporarily reduced to low output after a transmission line fault from the Pinotage substation, with the utility saying the reactors were not affected and that national reserves were sufficient to avoid load-shedding. The incident highlighted the system’s dependence on transmission reliability even as plant performance improves. A more dependable supply outlook may lower operational risk

premiums for energy-intensive companies and support medium-term investment sentiment, particularly for manufacturers, logistics operators and data-centre projects.

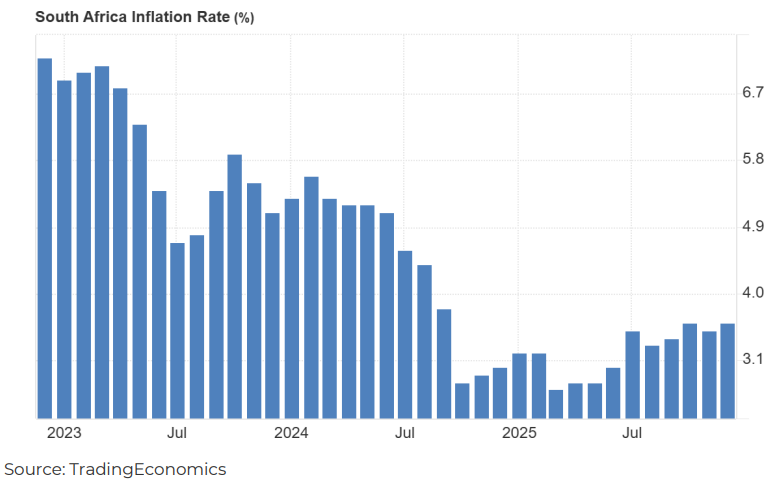

Inflation ends 2025 contained, with housing and food key

Consumer inflation edged up slightly to 3.6% year on year in December, from 3.5% in November, while prices rose 0.2% on the month. Statistics South Africa reported that housing and utilities [4.9%] and food and non-alcoholic beverages [4.4%] were the largest contributors to annual inflation, keeping the year-end profile a touch firmer even as the 2025 average came in at 3.2%, the lowest in 21 years. Core inflation, which strips out more volatile items, printed at 3.3% in December, underscoring a contained underlying trend. With inflation anchored near target, domestic rate expectations should remain broadly supportive for longer-dated bonds and interest-rate-sensitive sectors.

Budget consultation spotlights fiscal trade-offs ahead of February

The public was invited to submit suggestions for the 2026 Budget ahead of the Finance Minister’s budget speech on 25 February 2026. The consultation highlighted the trade-offs between supporting growth and vulnerable households and operating within tight fiscal limits, with input sought on spending priorities, the large deficit and stabilising state-owned entity finances. With debt-service costs still absorbing a material share of revenue, further reprioritisation across votes appears likely. Any signals on tax changes or spending restraint will be important for bond valuations and companies exposed to public-sector demand.

Barloworld delisting approved after compulsory acquisition

Barloworld confirmed that the JSE and A2X Markets approved the delisting of its ordinary shares after Newco completed a compulsory acquisition of the remaining shares on 22 January, following the earlier standby offer. The delisting is expected on 27 January, removing a long-standing industrial group from South Africa’s main equity boards and reducing local market free float. Investor focus now shifts to index and portfolio rebalancing as passive and benchmark-aware funds adjust holdings. The deal also points to continued interest from foreign-backed buyers in sizeable South African assets, which may support broader corporate deal activity.

KEY CURRENCY EXCHANGE MOVEMENTS OVER THE PAST 7 DAYS

19 January – 23 January 2026

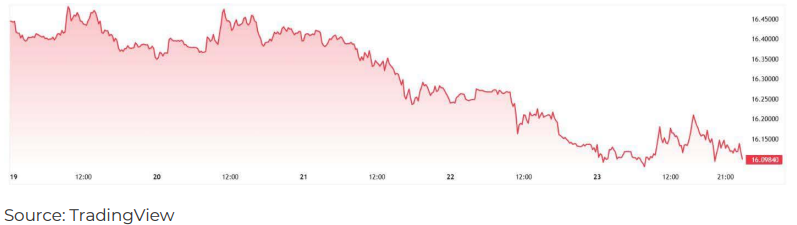

U.S. Dollar / South African Rand [USD/ZAR]

The rand strengthened from R16.44 on Monday’s open to R16.10 on Friday’s close [-2.07%].

The rand benefited from a softer U.S. dollar backdrop, helped by heightened geopolitical uncertainty and a rotation into gold that pushed bullion to fresh records and supported commodity-linked currencies. Locally, December inflation at 3.6% kept price pressures well contained, reinforcing expectations that the South African Reserve Bank still has room to ease later, while the rand also drew support from strong gold prices and improved sentiment around South Africa’s macro credibility

Movement: The USD/ZAR closed at R16.10 on Friday, 23 January 2026.

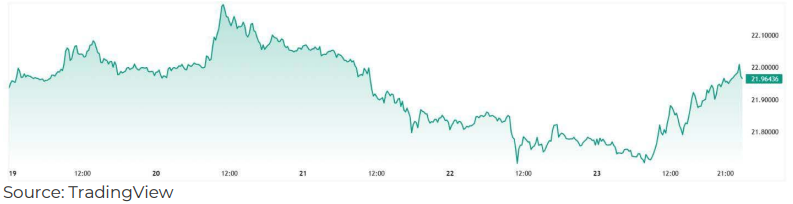

British Pound / South African Rand [GBP/ZAR]

The rand weakened from R21.94 on Monday’s open to R21.96 on Friday’s close [0.09%].

Sterling’s resilience was largely a United Kingdom story: December retail sales surprised on the upside [0.4% month-on-month] and the January flash business activity survey rose to 53.9, both of which supported the pound by nudging rate expectations towards fewer near-term cuts. That strength in GBP meant the rand’s broader support from gold and a weaker U.S. dollar did not translate cleanly into gains versus sterling, leaving the cross close to flat on the week.

Movement: The GBP/ZAR closed at R21.96 on Friday, 23 January 2026.

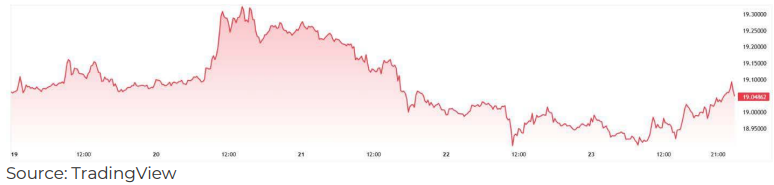

Euro / South African Rand [EUR/ZAR]

The rand strengthened from R19.06 on Monday’s open to R19.05 on Friday’s close [-0.05%].

The euro faced mixed Eurozone signals as the flash composite PMI held at 51.5 [below expectations], reflecting softer services momentum and diverging country trends [Germany firmer, France weaker]. Rising price-pressure indicators reinforced the view that the European Central Bank is in no hurry to adjust rates. Trade and tariff rhetoric linked to the Greenland dispute added near-term uncertainty, while the rand drew support from firm gold prices and contained domestic inflation, keeping the balance marginally rand-positive.

Movement: The EUR/ZAR closed at R19.05 on Friday, 23 January 2026.

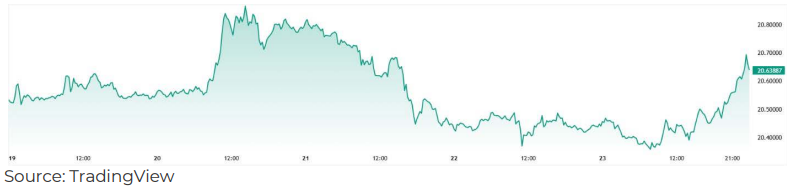

Swiss Franc / South African Rand [CHF/ZAR]

The rand weakened from R20.53 on Monday’s open to R20.64 on Friday’s close [0.54%].

Movement: The CHF/ZAR closed at R20.64 on Friday, 23 January 2026.

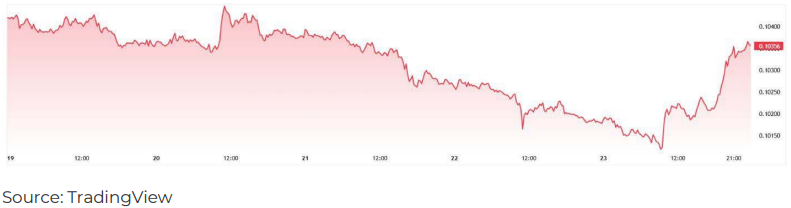

Japanese Yen / South African Rand [JPY/ZAR]

The rand strengthened from R0.1042 on Monday’s open to R0.1036 on Friday’s close [-0.58%].

Movement: The JPY/ZAR closed at R0.1036 on Friday, 23 January 2026.

WEEKLY JSE MOVERS OVER THE PAST 7 DAYS

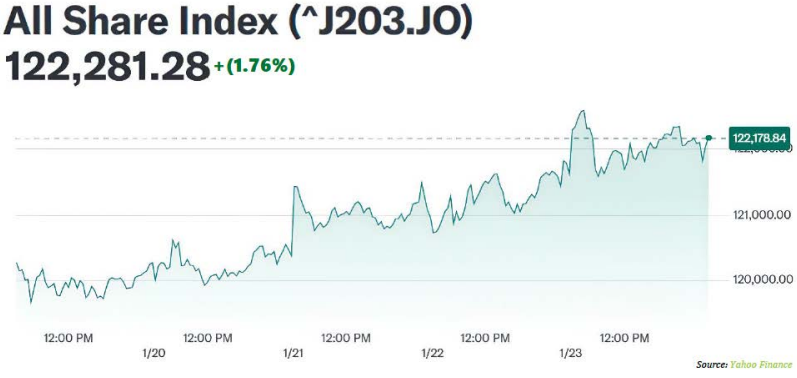

Overall Market | FTSE/JSE All-Share Index [J203]

The FTSE/JSE All Share Index [J203] rose 1.76% this week, closing at 122,281.28 on Friday after opening at 120,169.70 on Monday.

What Moved the Market

Record-setting precious metals and firmer expectations of easier global policy drew buyers back into JSE heavyweights, pushing the market higher.

- Precious metals led: Gold, silver, and platinum extended record runs, lifting gold and platinum group metal miners.

- United States policy expectations: A weaker dollar and growing conviction around rate cuts supported bullion and risk appetite.

- Local rates backdrop: Inflation tracking toward the 3% target kept the domestic policy environment supportive.

- Mining data softer: November mining output contracted year on year, highlighting operational constraints despite strong prices.

- Offshore markets supportive: Firmer Asian equities and gains on Wall Street improved emerging-market sentiment.

The advance remained commodity-driven, with precious metals doing most of the heavy lifting. Direction now hinges on whether bullion strength persists and how global policy expectations evolve.

Top Gainers

The gain likely reflected continued re-rating after the interim update showed improved financial positioning, including net debt reduced to R6.80 billion, lower net finance costs [down 16% to R294 million], an interim dividend of 15.0 cents per share, and ongoing share buy-backs. Sentiment was further supported by a turn around in the online betting division, with net gaming revenue [net of bonusing] up 15% to R136 million and adjusted EBITDA up 40% to R14 million since August 2025. Longer-term optionality from the approved relocation of the Caledon casino licence to Somerset West, alongside an estimated R1.29 billion development pipeline over two years, likely added to improved confidence around future earnings capacity.

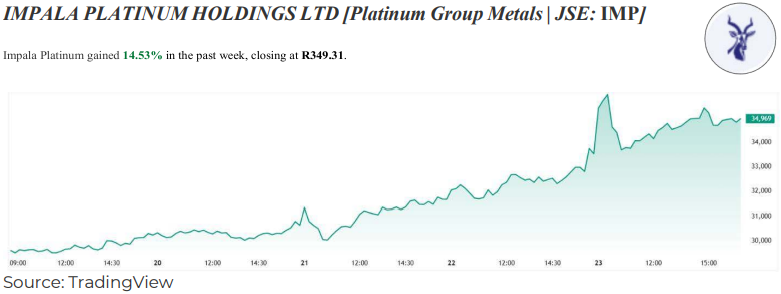

The gain was driven mainly by a sharp repricing across platinum group metals as platinum extended a record-setting rally, supported by a weaker US dollar and heightened risk aversion tied to renewed tariff threats, which tends to lift demand for precious metals. Higher spot prices can quickly translate into improved near-term cash flow expectations for PGM producers, and Implats typically shows meaningful operational leverage to moves in the PGM basket price, amplifying equity upside during metals rallies.

Top Losers

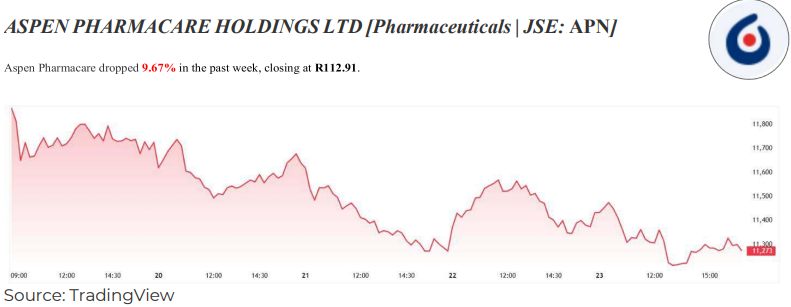

The decline largely reflected a pullback after a sharp re-rating linked to Aspen’s binding agreement to sell Aspen Asia Pacific [excluding China] for R26.5 billion [about 11x FY2025 normalised EBITDA], which left the share price sensitive to profit-taking and transaction repricing as the market digested the implied valuation and the group’s post-sale earnings mix. The week also had limited scope for new operational disclosure, with Aspen in a closed period until interim results on 3 March 2026, which may have kept trading more sentimentdriven than news-driven.

The sell-off followed Clicks’ trading update for the first 20 weeks to 11 January 2026, which highlighted slower comparable-store growth [3.7%] and clear near-term headwinds in the retail division. Management flagged intensified festive-season discounting by competitors and disruption from delays in implementing a warehouse management system at its Cape Town distribution centre, which reduced product availability in Western Cape stores and was estimated to have weighed on retail sales by about R120 million. The update also noted pressure in UPD’s managed turnover from the earlier non-renewal of two bulk agency distribution contracts, reinforcing concerns around mix and momentum despite solid pharmacy growth.

Key Industry Movements

At-a-Glance Takeaways

- ↑ Mining: Higher precious metal prices drove strong inflows.

- ↑ Financials: Rate-cut expectations and selective deal activity supported modest gains.

- ↑ Food Producers: Lower input costs offset weak demand.

- ↑ Real Estate: Falling bond yields supported valuations.

Mining | FTSE/JSE Mining Index [J177]

The FTSE/JSE Mining Index closed Friday at 169,535.20, up 5.23% from Monday’s open.

Global precious metals surged, with gold, silver and platinum pushing to fresh records as safehaven demand rose and the United States dollar weakened. The rally likely lifted JSE heavyweights across gold and platinum group metals, even as the rand firmed on expectations that South African interest rates could ease further. With policy and geopolitical uncertainty still shaping flows, the move suggests investors were willing to pay for hard-asset exposure, but momentum may stay sensitive to any reversal in the United States dollar or metal prices.

Financials | FTSE/JSE SA Financials Index [J580]

The FTSE/JSE SA Financials Index settled at 62,517.97 on Friday, up 1.06% from Monday’s open.

Rate-cut expectations strengthened after December inflation printed at 3.6% and the central bank reiterated that inflation is tracking toward the new 3% target, supporting the rand and bonds. Lower yields tend to favour banks and insurers via improved valuation support and a softer funding backdrop. Stock-specific support also came from deal activity, with Nedbank announcing an agreement to acquire a majority stake in Kenya’s NCBA. Overall, the gain points to improving risk appetite, but sentiment remains exposed to any surprise from the 29 January rate decision.

Agriculture | FTSE/JSE Food Producers Index [J357]

The FTSE/JSE Food Producers Index closed Friday at 10,227.21, up 0.35% from Monday’s open.

Moves were muted as investors weighed easing grain inputs against still-tight household budgets. Local wheat prices drifted down, with South African Futures Exchange [SAFEX] wheat ending at R5,706 per tonne after trading nearer R5,900 earlier in the week, helped by a stronger rand and lower import parity. December inflation ticked up to 3.6%, with food and non-alcoholic beverages among the contributors, keeping pricing power in focus. The small gain suggests cautious positioning ahead of rate decisions and company updates on volumes and costs.

Real Estate | FTSE/JSE All-Property Index [J803]

FTSE/JSE All-Property Index [J803] closed Friday at 12,270.07, up 0.59% from Monday’s open.

Listed property drew support from lower bond yields as markets priced further easing, with the 2035 benchmark yield dipping to around 8.185% late in the week. With December inflation at 3.6% and policy makers focused on a 3% target, the outlook for funding costs and valuations remained favourable. Company-specific catalysts were limited, so macro rates did most of the

work. The gain suggests improving sentiment,but remains vulnerable to any reversal in yields.

INTERNATIONAL NEWS AFFECTING SOUTH AFRICA

The week was defined by firmer global growth expectations, uneven signals from China, a steadier United States rate outlook, softer oil market pressures, and renewed trade-policy uncertainty shaping global risk sentiment.

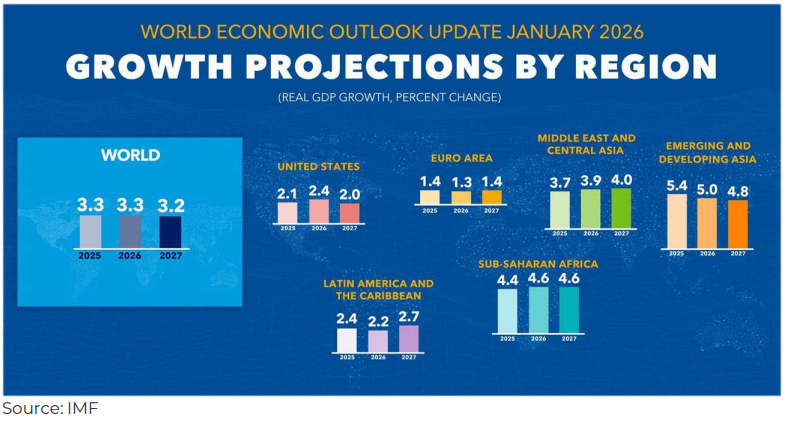

IMF growth view edges up

Global growth is projected at 3.3% in 2026 and 3.2% in 2027, slightly higher than the October update, as technology investment and supportive financial conditions offset trade-policy shifts. The IMF still highlighted renewed trade frictions and uneven inflation progress as key risks, which could reprice bonds and currencies quickly if shocks arrive. The key signal is that global demand appears steady enough to support trade volumes, but disinflation is not yet uniform, so central banks may remain cautious and policy rates may stay restrictive for longer in some economies. For South African assets, that mix matters because it shapes demand for commodity exports and the pricing of emerging-market risk, both central to the rand and the JSE’s global cyclicals tilt. The update also implies markets will remain sensitive to fiscal and inflation credibility, with risk premia moving quickly when policy uncertainty rises.

Trade fragmentation theme returns at Davos

Trade policy uncertainty re-emerged as a central concern at the World Economic Forum in Davos as the United States increasingly used tariffs as a strategic foreign-policy tool, reinforcing a shift away from open multilateral trade toward more transactional and regionally aligned systems. Governments and corporates signalled a stronger focus on supply-chain resilience, friend-shoring, and regional trade agreements, with renewed attention on large blocs such as the European Union’s Mercosur pact as firms seek predictable regulatory environments and enforceable legal frameworks. For South Africa, a more fragmented trade order can reshape export demand, particularly for commodities and manufactured inputs, while raising logistics and compliance costs. This environment tends to increase price volatility and risk premia across emerging markets, especially when trade policy signals shift abruptly or lack coordination.

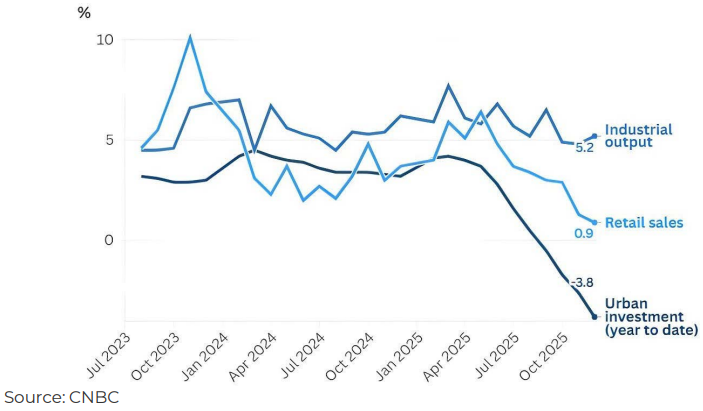

China data shows mixed momentum

China published a detailed 2025 activity snapshot showing consumption and trade growth alongside persistent property weakness. Retail sales reached 50,120.2 billion yuan, up 3.7%, with online retail sales up 8.6%, while goods exports rose 6.1%. Real estate development investment fell 17.2%, and the value of new commercial building sales declined 12.6%. Inflation was flat year-on-year and producer prices fell 2.6%, pointing to muted pricing power despite pockets of strength in services and high-tech investment. For South Africa, the message on Chinese demand is still the primary driver for bulk commodities, so softer property-linked activity can weigh on sentiment in metals and mining shares even when headline trade data looks firm.

United States rates seen staying higher

The International Energy Agency projected a deep oil surplus in the first quarter of 2026, estimating that supply would exceed demand by 4.25 million barrels per day, even as geopolitical risks remain present. The assessment reflected rising output from multiple producers alongside only gradualdemandgrowth, with OPEC+optingtopause further supply increases. The projection reinforces the view that near-term oilmarketbalances are loosening, reducingthe likelihoodof sustainedupwardpressure oncrudeprices. For South Africa, a softer oil backdrop can ease fuel-price inflation, lower transport and input costs, and reduce

pressure on monetary policy. Lower oil import costs also support the current account at the margin, although the risk of sudden supply disruptions has not disappeared.

IEA flags early-2026 oil surplus

The International Energy Agency projected a deep oil surplus in the first quarter of 2026, estimating supply would exceed demand by 4.25 million barrels per day, even as geopolitical risks lingered. The agency cited rising output from multiple producers and only gradual demand growth, with OPEC+ pausing further supply increases. For South Africa, a looser oil balance can feed through to lower fuel-price pressure, easing headline inflation and potentially reducing the risk of tighter local monetary policy. Lower oil import costs also tend to support the current account at the margin, though sudden supply disruptions remain a key upside risk for prices.

SOURCES INCLUDED BUT NOT LIMITED TO

This report is published by Everest Wealth for general information and educational purposes only and does not constitute financial advice as defined by the Financial Advisory and Intermediary Services Act, 2002 (FAIS Act). The content is based on market research conducted around the reporting date. Figures and insights may change due to market conditions. Please note that past performance is not indicative of future results. Please consult with a licensed Financial Advisor to determine if such investments are appropriate for your individual circumstances.

Everest Wealth Management (Pty) Ltd is an authorised Financial Services Provider (FSP 795) and a registered credit provider NCRCP 21504