Markets Move Ahead of the Economy

Financial markets strengthened on easing rates and firmer commodities, even as underlying economic activity remained subdued.

SOUTH AFRICAN FINANCIAL AND ECONOMIC NEWS

Key domestic developments during the week offered insight into the state of economic momentum, cost pressures, and policy direction in South Africa.

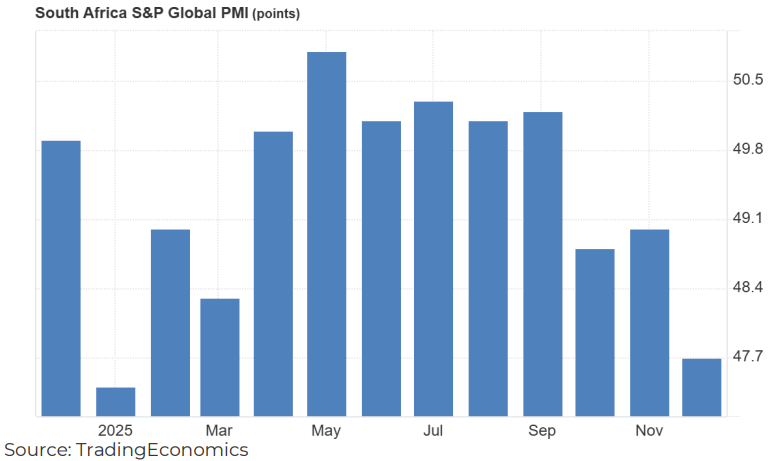

Private-sector activity softens into year-end

South Africa’s S&P Global Purchasing Managers’ Index [PMI] fell to 47.7 in December from 49.0 in November, staying below the 50.0 line that separates expansion from contraction and leaving the whole final quarter of 2025 in negative territory. The survey pointed to weaker demand, with output and new orders falling sharply and new work intakes recording their steepest drop since March 2024. Firms trimmed purchases and inventories, and export sales slipped after a marginal rise in November. Employment edged higher for a third month, though only fractionally, suggesting firms are holding capacity despite softer volumes. Businesses remained more optimistic about 2026, but the December reading still signals a cautious start to the year

Electricity pricing uncertainty returns to the agenda

Nersa’s consultation matters because it reopens the question of how much revenue Eskom is legally allowed to recover from customers over the current three-year tariff window [MYPD6], after the Pretoria High Court rejected a behind-closed-doors R54 billion settlement and ordered a fresh, transparent process. The core issue is a material calculation error in the regulator’s earlier determination, linked to how Eskom’s asset base and related returns were treated, which Nersa now proposes to

correct through an additional R76 billion revenue allowance. If approved, the adjustment could lift the headline trajectory of future annual increases versus what was previously communicated, with knock-on effects for municipal tariffs, energy-intensive industries, and the inflation outlook [especially where higher electricity costs feed into administered prices and production costs].

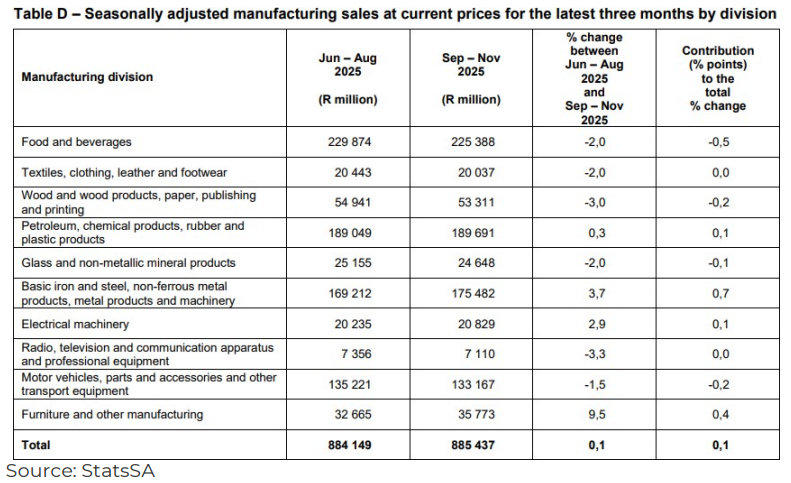

Manufacturing output retreats in November

Statistics South Africa reported that the volume of manufacturing production fell 1.0% in November 2025 compared with November 2024, and declined 1.1% month-on-month on a seasonally adjusted basis. Weakness was concentrated in wood and

wood products, paper, publishingand printing[down 7.9%], basic iron and steel and related metal products [down 2.5%], and motor vehicles and components [down 4.4%]. These declines were partly offset by a 5.5% increase in petroleum, chemical

products, rubber, and plastic products. On a three-month comparison, seasonally adjusted production rose 0.6% versus the prior three months, suggesting activity remains uneven rather than on a clear upward path. The mix of declines and pockets of growth points to continued pressure on industrial demand.

Fuel price cuts offer near-term inflation relief

The Department of Mineral Resources and Energy reduced regulated fuel prices from 7 January, reflecting softer international refined product prices over the review period. Lower petrol and diesel costs should ease pressure on transport and distribution, supporting a moderation in short-term inflation, particularly for goods with high logistics intensity. The extent of the benefit will depend on pass-through across freight, public transport, and retail pricing, as well as whether global energy prices remain relatively stable in coming months.

New prosecuting chief raises expectations on economic crime

President Cyril Ramaphosa appointed Andy Mothibi as National Director of Public Prosecutions, bringing experience from the Special Investigating Unit and senior governance roles across the public and private sectors. The appointment refocuses attention on improving prosecutions of corruption and financial crime, which remain a drag on institutional credibility and confidence. However, delivery will depend on addressing capacity constraints, clearing complex case backlogs, and strengthening coordination across the criminal justice system.

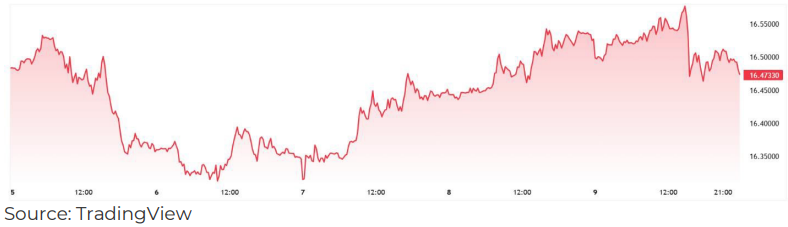

KEY CURRENCY EXCHANGE MOVEMENTS OVER THE PAST 7DAYS.

5 January 2025 – 9 January 2026

U.S. Dollar / South African Rand [USD/ZAR]

The rand strengthened from R16.48 on Monday’s open to R16.47 on Friday’s close [-0.06%].

The pair mostly tracked shifting U.S. rate expectations and global risk tone. Early in the week, the dollar softened after the Fed signalled a greater willingness to cut rates if labour market conditions weaken, but it later found support as traders positioned

for U.S. labour-market releases and digested mixed U.S. data. Locally, a weaker December PMI briefly weighed on sentiment, but strong equity levels and steady domestic bond markets helped keep the rand supported overall.

Movement: The USD/ZAR closed at R16.47 on Friday, 9 January 2026

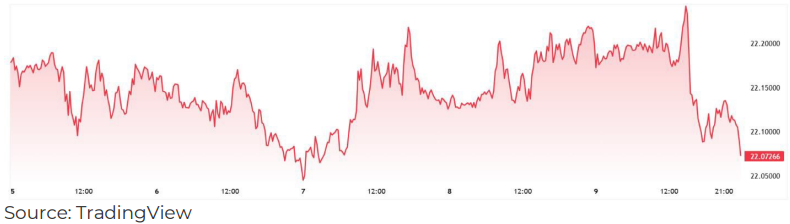

British Pound / South African Rand [GBP/ZAR]

The rand strengthened from R22.18 on Monday’s open to R22.07 on Friday’s close [-0.50%].

Sterling’s tone was driven mainly by shifting risk appetite and the UK policy outlook, with markets still calibrating the Bank of England path after its December cut and awaiting upcoming UK GDP and labour-market data for clearer direction. Sterling

also lost ground when the dollar firmed and broader sentiment turned more cautious, which reduced support for higher-beta currencies across FXmarkets. With the rand broadly steady, these swings in sterling were enough to tilt the cross lower.

Movement: The GBP/ZAR closed at R22.07 on Friday, 9 January 2026.

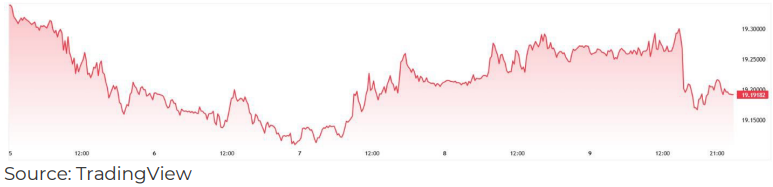

Euro / South African Rand [EUR/ZAR]

The rand strengthened from R19.34 on Monday’s open to R19.19 on Friday’s close [-0.78%].

The euro was weighed down by a data mix that reinforced a low-volatility rates outlook in the euro area, with inflation cooling in several major economies and activity indicators pointing to modest growth led by services rather than manufacturing. At the same time, the dollar’s firmer tone into the U.S. payrolls release limited euro upside in broader FX markets. Against that backdrop, a supported rand, helped by stable local markets and improving mediumterm sentiment around South Africa’s fundamentals, left the cross biased lower.

Movement: The EUR/ZAR closed at R19.19 on Friday, 9 January 2026.

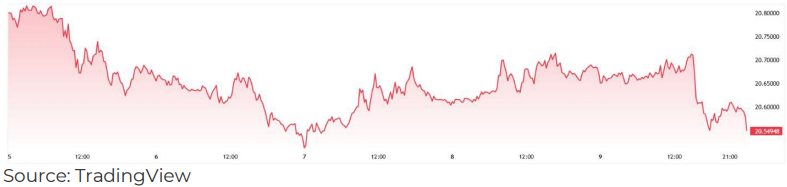

Swiss Franc / South African Rand [CHF/ZAR]

The rand strengthened from R20.80 on Monday’s open to R20.55 on Friday’s close [-1.21%].

Movement: The CHF/ZAR closed at R20.55 on Friday, 9 January 2026.

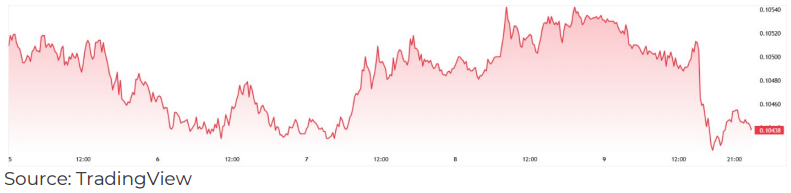

Japanese Yen / South African Rand [JPY/ZAR]

The rand strengthened from R0.1051 on Monday’s open to R0.1044 on Friday’s close [-0.67%].

Movement: The JPY/ZAR closed at R0.1044 on Friday, 9 January 2026.

WEEKLY JSE MOVERS OVER THE PAST 7 DAYS

Overall Market | FTSE/JSE All-Share Index [J203]

The FTSE/JSE All Share Index [J203] rose 1.74% this week, closing at 118,110.22 on Friday after opening at 116,092.00 on Monday.

What Moved the Market

A renewed precious-metals rally and improved sentiment around JSE market reforms drew buying back into heavyweight resource counters.

• Precious metals bid: Gold rebounded toward record levels on geopolitical tension and softer United States data, lifting local miners.

• Listing rules catalyst: Planned reforms to JSE listing requirements improved confidence in the market’s competitiveness.

• Foreign flow narrative: Early-week gains were reinforced by renewed foreign interest and higher turnover.

• Manufacturing drag: The December Absa PMI fell sharply, keeping the domestic growth backdrop weak.

• Global mining tone: Improved sentiment around global miners supported the resources complex.

Commodities and sentiment, rather than domestic growth, drove the advance. Precious-metals strength and reform optimism supported resource heavyweights, while weak manufacturing data capped broader participation.

Top Gainers

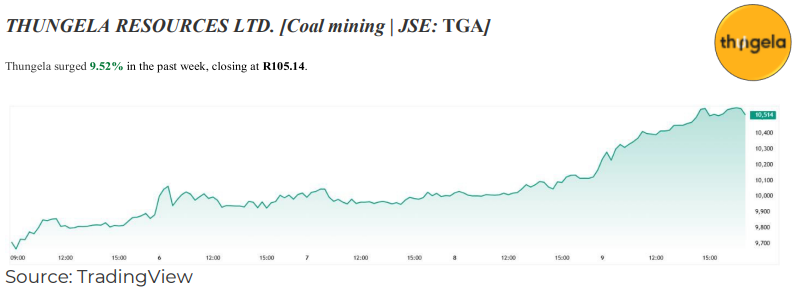

The move was supported by improving confidence in volumes and cash generation after the group’s December pre-close update flagged South African export equity sales of about 13.6 million tonnes for FY2025 [up from 12.6 million tonnes], helped by stronger export production and better rail performance, alongside continued shareholder returns via dividends and buybacks and guidance for a year-end net cash balance of roughly R4.9 billion to R5.2 billion. Sentiment towards South African coal exporters has also been underpinned by the view that logistics constraints may ease further as Transnet progresses with multi-year rail and port upgrade plans, and by evidence of shifting seaborne demand patterns that have increased South African coal flows into certain markets.

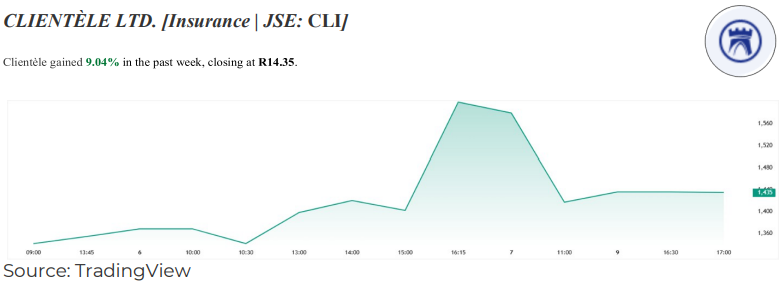

The gain appears consistent with ongoing re-pricing after the group’s FY2025 trading update and annual results highlighted a step-change in earnings, with headline earnings attributable to equity holders up 100% to R659.9 million and a dividend declared of 132 cents per share, alongside the consolidation and integration of 1Life and the recently approved Emerald Life acquisition. With no material new operational shock evident in the period, the move likely reflects investors continuing to position around the stronger reported profitability and capital return profile signalled in those releases.

Top Losers

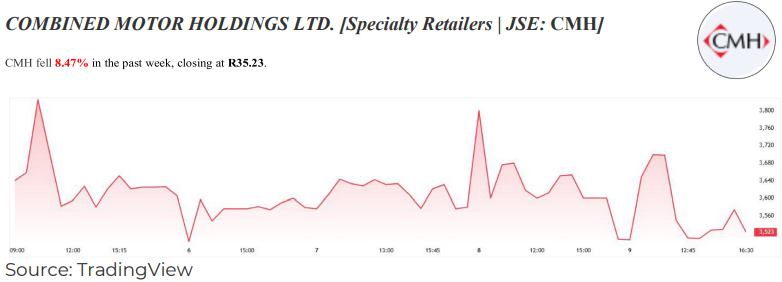

The sell-off was driven less by fresh fundamentals and more by a sharp reversal after an outsized run. The share, which had been the JSE’s top performer in 2025, dropped heavily in a single session on 8 January with no obvious company news, while volumes spiked to roughly 10 times the prior 52-week daily average. With a very small effective free float [top shareholders hold the bulk of the register], price moves can be exaggerated by relatively modest flows, and the week’s decline looks consistent with profit-taking and liquidity dynamics after valuations had become stretched versus the broader market.

The weakness likely reflects post-capital-return positioning and thin holiday period liquidity rather than a new operational shock. CMH had recently run a voluntary pro rata share repurchase at R35.50 per share, closing on 12 December, with 5,377,194 shares accepted for repurchase [7.1886% of issued shares] and settlement on 15 December, including meaningful director-related participation. With that cash exit route behind the market, the share price appears to have drifted lower as shareholders who bought around the corporate action rebalanced, while the reduced free float and typically modest liquidity can amplify week-to-week swings.

Key Industry Movements

At-a-Glance Takeaways

• ↑ Mining: Firmer metal prices and improved risk appetite supported miners.

• ↑ Financials: Lower bond yields supported banks and insurers.

• ↑ Food Producers: Easing costs lifted food producers.

• ↑ Real Estate: Rate-cut expectations supported listed property.

Mining | FTSE/JSE Mining Index [J177]

FTSE/JSE Mining Index [J177] closed Friday at 147,070.20, up 2.34% from Monday’s open.

Mining shares were supported by firmer precious metal prices, particularly gold, as expectations of lower global interest rates improved the appeal of bullion-linked assets. Strength in platinum group metals also aided sentiment toward locally listed

producers. Improved global risk appetite and renewed offshore interest in South African assets added support, even as a firmer rand limited some revenue upside. Near-term direction remains sensitive to US economic data and shifts in interest rate expectations.

Financials | FTSE/JSE SA Financials Index [J580]

FTSE/JSE SA Financials Index [J580] settled at 61,907.80 on Friday, up 1.01% from Monday’s open.

Lower long-dated bond yields underpinnedbank and insurer valuations as funding and discount rate assumptions eased. Focus remained on the upcoming South African Reserve Bank decision, with investors assessing the scope for further rate cuts. Large, liquid banks continued to attract interest due to balance sheet resilience. Performance ahead will likely hinge on credit demand trends and asset quality as growth conditions evolve.

Agriculture | FTSE/JSE Food Producers Index [J357]

FTSE/JSE Food Producers Index [J357] closed Friday at 10,338.66, up 2.39% from Monday’s open.

The sector benefited from easing cost pressures, supported by lower fuel prices, moderating inflation and a steadier rand. Investors favoured companies positioned to capture operating leverage from recent efficiency and capital investment initiatives. Food producers also attracted defensive demand amid uneven economic conditions. Sustainability of gains will depend on whether margin improvements offset ongoing pressure on household spending.

Real Estate | FTSE/JSE All-Property Index [J803]

FTSE/JSE All-Property Index [J803] closed Friday at 12,294.01, up 1.89% from Monday’s open.

Property stocks were supported by lower bond yields and expectations of further interest rate relief, improving valuation support. Better earnings execution and tighter capital discipline reinforced confidence following last year’s recovery. Rate sensitive sectors remained in favour ahead of the next policy decision. Future performance will depend on the pace of rate cuts and progress on vacancies, rentals and leverage.

INTERNATIONAL NEWS AFFECTING SOUTH AFRICA

Global macroeconomic and policy developments over the past week shaped risk sentiment, interest rate expectations, and commodity outlooks, with several themes carrying direct implications for South African financial markets.

United States jobs data reinforces focus on interest rates

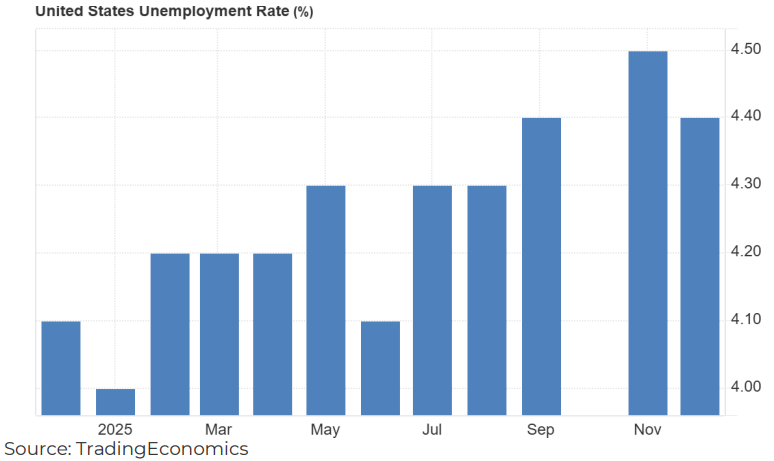

US payroll growth slowed sharply in December, with the unemployment rate easing to 4.4%, reinforcing the picture of a labour market in a low-hire, low-fire phase after only 584,000 jobs were added in 2025. Reuters noted that hiring was narrow, with retail shedding jobs and manufacturing continuing to contract, partly linked to tariff-driven uncertainty. The print suggests the Federal Reserve may prefer to keep rates steady in the near term, while leaving market pricing sensitive to the next inflation readings and any signs of broader job losses. For South Africa, shifts in US rate expectations can move global risk appetite, influencing local bond yields and the valuation of rate-sensitive shares.

China signals looser monetary policy for 2026

China’s central bank said it plans to cut banks’ reserve requirement ratios and interest rates in 2026 to keep liquidity ample, alongside counter-cyclical adjustments aimed at supporting steady growth and defusing financial risks. Reuters reported the People’s Bank of China also intends to guide reasonable credit expansion and keep the yuan broadly stable at a reasonable and balanced level after leaving its loan prime rates unchanged for a seventh straight month in December. The policy shift matters because China remains a key source of incremental demand for South African exports, particularly commodities. If easier Chinese financial conditions translate into firmer activity, it may lift expectations for mining earnings and support sentiment towards South African equities and credit.

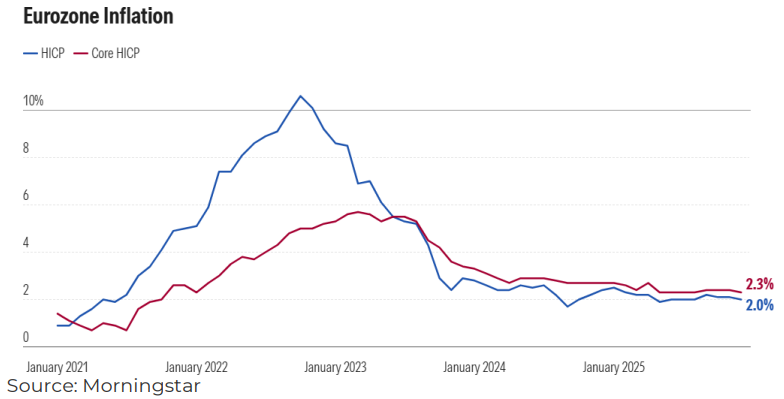

Euro zone ends 2025 with modest momentum, inflation near target

Fresh euro zone data suggested the bloc ended 2025 in modestly better shape than feared. Retail sales rose 0.2% month-on-month in November and were up 2.3% year-on-year, while German industrial output grew 0.8% and orders jumped 5.6%. Inflation was described as being near 2%, which may leave the European Central Bank inclined to pause after two years of rate cuts, even as growth remains subdued. The same releases highlighted a weak export backdrop, with German exports to the United States down 22.9% year-on-year after new tariffs. For South Africa, steadier European demand can underpin export-linked earnings, while shifts in European rates and risk sentiment can influence offshore flows into local bonds and equities.

Oil market seen in surplus in 2026, but volatility risks remain

Oil markets are widely expected to move into surplus during 2026, with estimates pointing to excess supply of roughly 0.5 to 3.5 million barrels per day following higher production targets set by OPEC+ in 2025. Price expectations for Brent crude cluster in a broad $55 to $68 a barrel range, reflecting competing forces between ample supply and potential upside risks. Support factors include the possibility of renewed OPEC+ restraint and tighter United States sanctions affecting Russian oil flows, while uncertainty around Venezuelan output remains unresolved. The contrast between OPEC’s assessment of a near-balanced market and more cautious global supply demand projections suggests volatility is likely to persist. For South Africa, the oil

trajectory feeds directly into inflation expectations, transport costs, and the valuation of rate-sensitive assets.

Geopolitical shocks raise the risk of sudden repricing across markets

Geopolitical risk resurfaced at the start of 2026 after the United States arrested Venezuelan President Nicolas Maduro, prompting markets to assess potential energy-market disruption and the direction of interim leadership in Caracas. At the same time, President Donald Trump threatened higher tariffs on India if it does not curb purchases of Russian oil, adding uncertainty to global trade dynamics. Such policy shocks matter because they can tighten financial conditions and drive asset

repricing even without new economic data. For South Africa, heightened geopolitical uncertainty can support risk-off behaviour, influencing offshore flows into local bonds and equities andincreasing sensitivity to commodity price movements.

SOURCES INCLUDED BUT NOT LIMITED TO

This report is published by Everest Wealth for general information and educational purposes only and does not constitute financial advice as defined by the Financial Advisory and Intermediary Services Act, 2002 (FAIS Act). The content is based on market research conducted around the reporting date. Figures and insights may change due to market conditions. Please note that past performance is not indicative of future results. Please consult with a licensed Financial Advisor to determine if such investments are appropriate for your individual circumstances.

Everest Wealth Management (Pty) Ltd is an authorised Financial Services Provider (FSP 795) and a registered credit provider NCRCP 21504