SA Markets This Week: Rand Performance, JSE Movers and Global Events

While global markets entered 2026 with higher volatility, South Africa’s trade position, energy supply, and bond market remained comparatively stable.

SOUTH AFRICAN FINANCIAL AND ECONOMIC NEWS

The past week delivered several important developments across public finances, energy supply, capital markets regulation and corporate strategy, offering useful signals on South Africa’s neartermeconomic and policy trajectory.

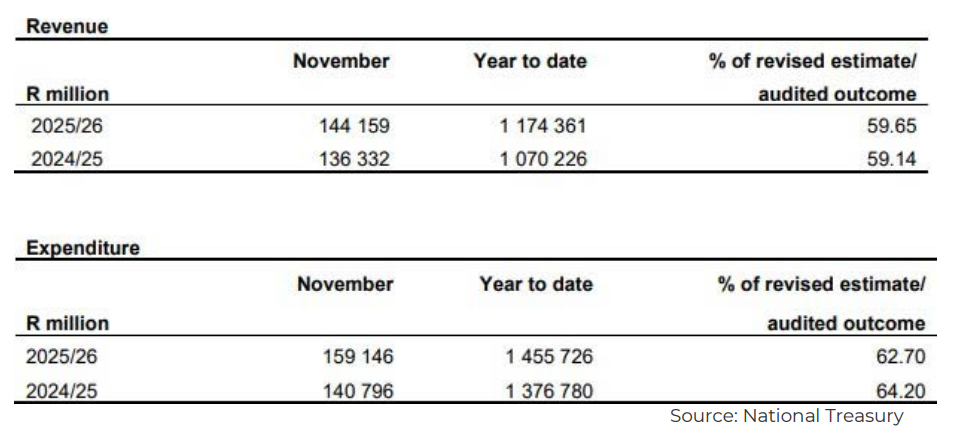

Fiscal position update from National Treasury

National Treasury’s Section 32 statement [as at 30 November 2025] showed revenue tracking broadly in line with plan at 59.65% of the revised 2025/26 estimate, while expenditure was higher at 62.70%. Year to date, revenue of R1,174,361 million was up R104,135 million [9.7%] on the comparable prior year figure, but spending of R1,455,726 million still exceeded revenue by about R281,365 million, underscoring the persistence of the fiscal gap. November’s composition also highlighted where thepressure sits: transfers andsubsidies totalled R125,392 million [voted funds plus direct charges], while direct charges overall were R65,591 million, and payments for capital assets were only R1,567 million. Financing for November was dominated by domestic issuance [domestic long term loans R30,185 million and short term net loans R3,273 million], alongside an increase in cash and other balances [shown as -R17,957 million]. The MTBPS frames this trajectory as consistent with a strategy to stabilise debt and lift the primary surplus over the medium term.

Climate Commission refreshed for 2026 to 2030

President Cyril Ramaphosa announced a new cohort of 25 commissioners for the Presidential Climate Commission for the 2026 to 2030 tenure under the Climate Change Act, 2024. The commission brings together representatives from business, labour, civil society, traditional leadership, youth and local government, with a mandate to provide independent, evidence based advice and facilitate consensus on South Africa’s just transition. For markets, the key point is governance: the commission sits at the intersection of energy, industrial policy and climate finance, where clearer priorities can influence project pipelines, regulatory sequencing and the credibility of transition plans. The Presidency said the appointments followed a public nomination process and are intended to balance skills, sector representation and geographic spread.

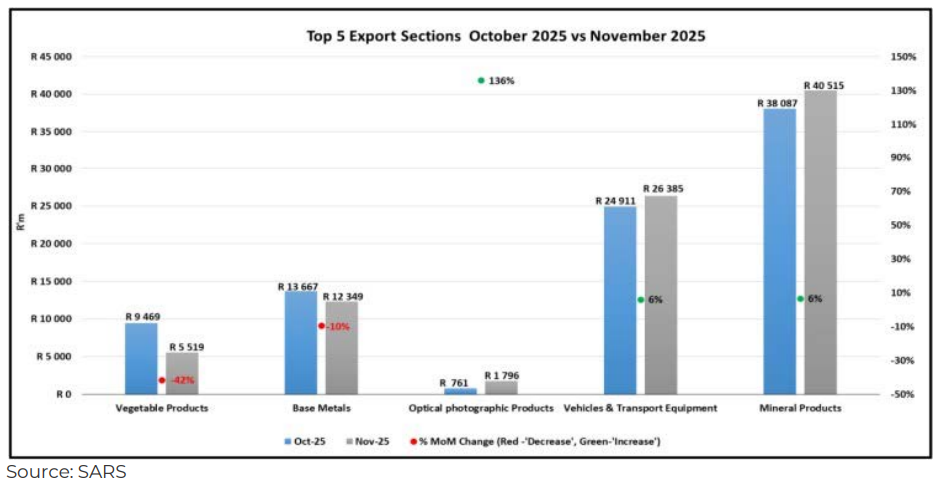

SARS trade balance widens in November

SARS trade data showed South Africa’s preliminary trade balance shifted to a R37.7 billion surplus in November 2025, driven by exports of R188.0 billion and imports of R150.3 billion [including Botswana, Eswatini, Lesotho and Namibia]. Month on month, exports slipped by R3.6 billion[-1.9%],while imports fell by R26.4 billion [-14.9%], lifting the surplus versus October’s R15.0 billion. The export decline was concentrated in citrus fruit, unwrought aluminium and gold, while the import pullback reflected lower volumes of petroleum oils [excluding crude], original equipment components and passenger motor vehicles. The swing suggests softer import demand and easing fuel import pressure, providing a near term cushion for the current account heading into year end.

JSE listing rulebook to be simplified

The Johannesburg Stock Exchange received regulatory approval from the Financial Sector Conduct Authority for amendments under its Listing Requirements Simplification Project, with the new rulebook taking effect on 13 January 2026. The exchange’s stated aim is to make listing obligations clearer and cheaper to comply with, using plain language and reducing the overall volume of requirements while keeping core investor protections. The change is framed as a response to a long decline in public listings, from more than 850 companies in the 1990s to fewer than 300 today, as issuers weigh costs and administrative burden against private capital alternatives. If implementation is smooth, the initiative could modestly improve capital raising options for mid sized firms and support market depth over time.

Eskom reports sustained supply gains

Eskom reported that system conditions over the holiday period remained stable, with the Energy Availability Factor up 12.57% on a year on year basis and average unplanned outages down 5,506MW versus the same period last year. It said South Africa had seen 231 consecutive days without an interrupted supply, with only 26 hours of load shedding earlier in the financial year. Lower unplanned outages also reduced reliance on diesel fired peaking plants, with no diesel used for two consecutive weeks and year to date diesel costs of R6.232 billion for 1,049.38GWh generated. The update matters for growth and inflation because improved supply lowers operating disruption and eases the pressure on public support mechanisms.

KEY CURRENCY EXCHANGE MOVEMENTS OVER THE PAST 7DAYS.

29 December 2025 – 2 January 2026

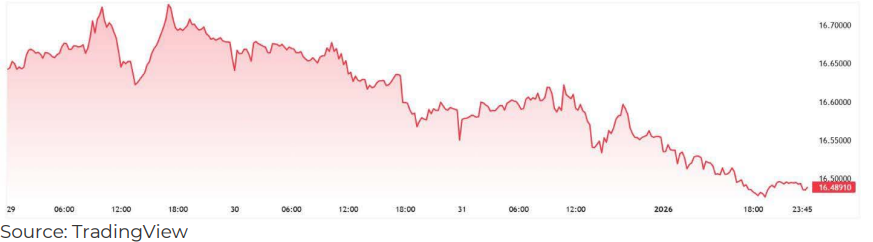

U.S. Dollar / South African Rand [USD/ZAR]

The rand strengthened from R16.64 on Monday’s open to R16.49 on Friday’s close [-0.90%].

The rand was supported by a softer U.S. dollar backdrop into year end, with markets still anchored on expected Federal Reserve easing and related concerns that kept the greenback under pressure. That global tailwind was reinforced by South Africa’s supportive terms of trade, with precious metals strength and ongoing confidence gains linked to improved fiscal and inflation outcomes. Thin holiday liquidity likely amplified day to day moves.

Movement: The USD/ZAR closed at R16.49 on Friday, 2 January 2026.

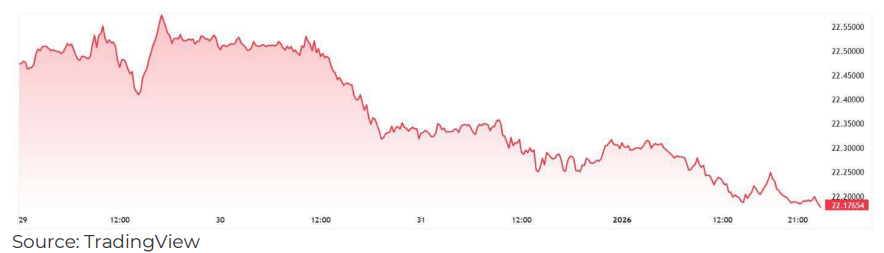

British Pound / South African Rand [GBP/ZAR]

The rand strengthened from R22.47 on Monday’s open to R22.18 on Friday’s close [-1.29%].

Sterling lacked a clear positive catalyst over the period, with the United Kingdom still weighed down by slow growth and public finance concerns, alongside an easing bias after multiple Bank of England cuts through 2025. In that context, the rand’s broader support from commodities and a more constructive South Africa narrative left GBP/ZAR drifting lower in subdued, holiday thinned trading.

Movement: The GBP/ZAR closed at R22.18 on Friday, 2 January 2026.

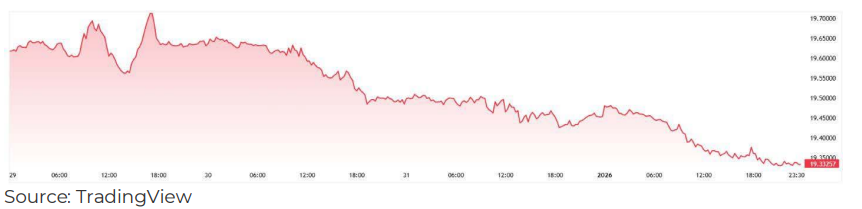

Euro / South African Rand [EUR/ZAR]

The rand strengthened from R19.62 on Monday’s open to R19.33 on Friday’s close [-1.48%].

The euro was pressured by weak euro area activity signals, including soft manufacturing data, while the policy outlook remained largely steady rather than supportive for euro carry. Against that, the rand continued to benefit from commodity linked inflows and a view that progress on domestic reforms could improve confidence and capital flows, with thin liquidity conditions likely exaggerating the week’s directional bias

Movement: The EUR/ZAR closed at R19.33 on Friday, 2 January 2026.

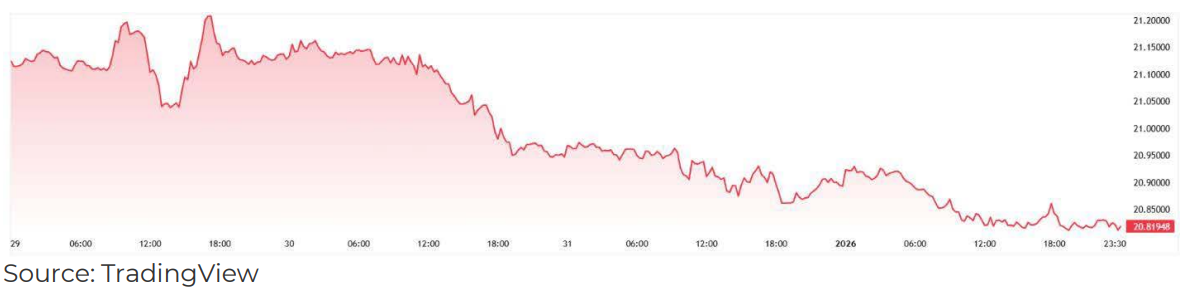

Swiss Franc / South African Rand [CHF/ZAR]

The rand strengthened from R21.12 on Monday’s open to R20.82 on Friday’s close [-1.42%].

Movement: The CHF/ZAR closed at R20.82 on Friday, 2 January 2026.

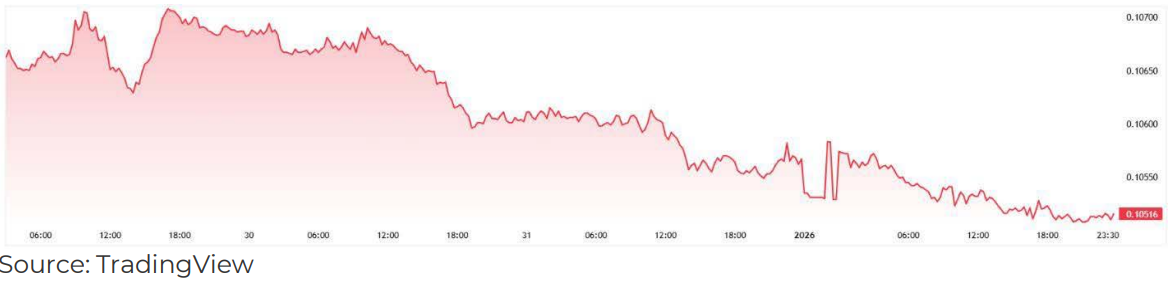

Japanese Yen / South African Rand [JPY/ZAR]

The rand strengthened from R0.1066 on Monday’s open to R0.1052 on Friday’s close [-1.31%].

Movement: The JPY/ZAR closed at R0.1052 on Friday, 2 January 2026.

WEEKLY JSE MOVERS OVER THE PAST 7 DAYS

Overall Market | FTSE/JSE All-Share Index [J203]

The FTSE/JSE All Share Index [J203] fell 0.85% this week, closing at 116,091.98 on Friday after opening at 117,085.50 on Monday.

What Moved the Market

Profit taking after a strong year end run, amplified by thin holiday trading and renewed precious metals volatility, pulled the JSE lower.

• Precious metals volatility: Gold and silver swung sharply, with post record selloffs weighing on resource counters.

• Commodity breather: Profit taking in bullion reduced momentum in mining heavyweights.

• Thin liquidity: Year-end trading conditions amplified price moves and limited conviction.

• Global lead mixed: Offshore markets started the year unevenly, offering little support to risk assets.

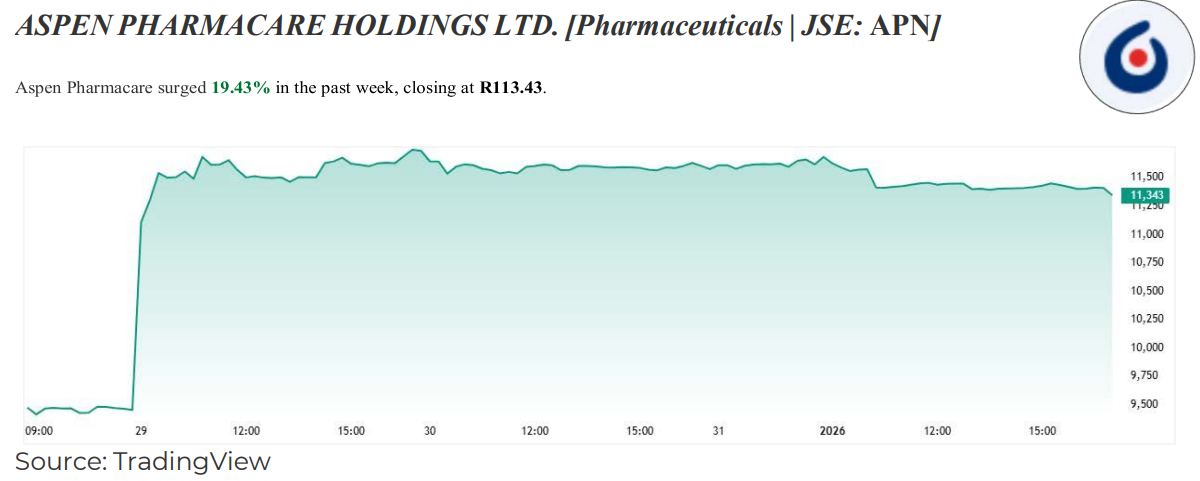

• Stock specific offset: Aspen rose on the sale of its Asia Pacific assets, but the move lacked broader follow through.

The week reflected positioning rather than fundamentals. Volatile commodities and thin liquidity encouraged profit taking, leaving the market modestly weaker into early January.

Top Gainers

The rally followed Aspen’s announcement of a binding agreement to sell its Asia Pacific operations [excluding China] to BGH Capital for R26.5 billion. The transaction implies a favourable valuation relative to earnings and is expected to materially reduce group debt, while simplifying the portfolio and sharpening strategic focus. The market response suggests investors viewed the disposal as a meaningful de-risking step and a positive reset for capital allocation after a prolonged period of pressure on the share.

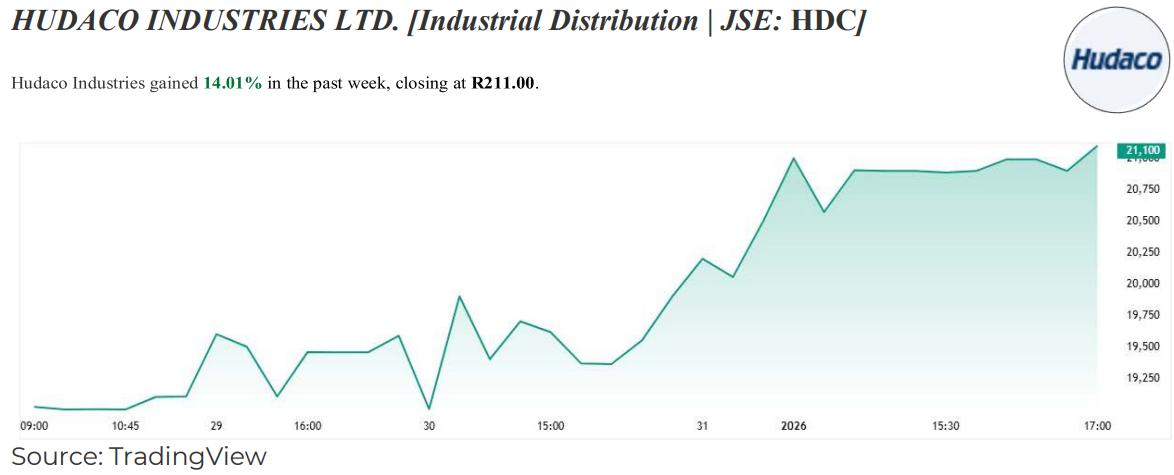

There were no new company-specific disclosures during the week, indicating the move was likely driven by year-end liquidity conditions and renewed buying interest rather than fresh news. In thin holiday trading, relatively modest demand can lead to outsized price moves. The advance also aligns with positive underlying sentiment toward Hudaco’s defensive earnings profile, cash generation, and expectations that prior acquisitions will contribute more meaningfully in the second half of the financial year.

Top Losers

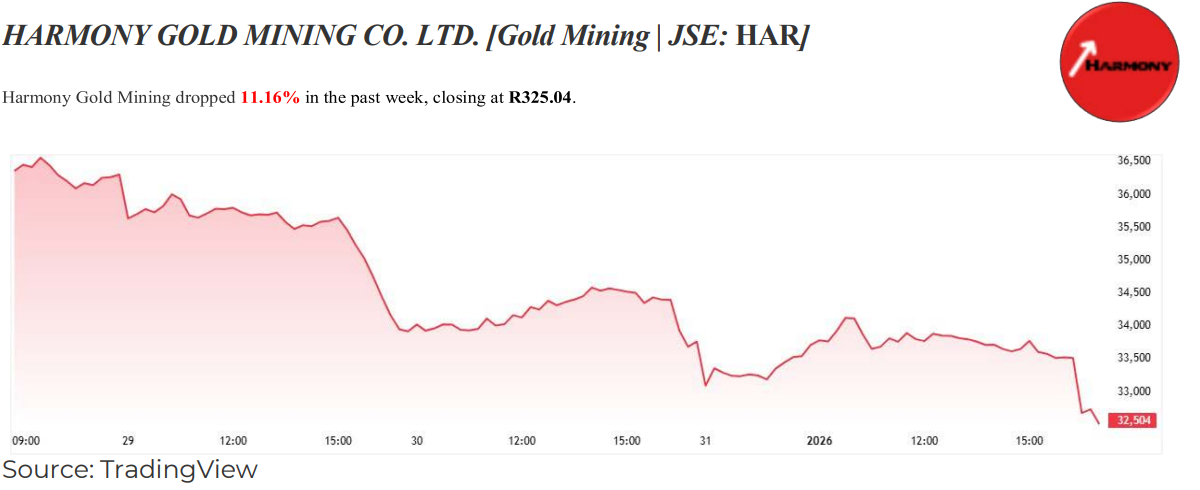

The sell-off largely tracked a broader pullback in precious-metals-linked assets as gold eased from near-record levels and investors locked in profits, a dynamic that often hits higher-beta gold miners harder than the underlying metal. A firmer rand into year-end and early January also likely compressed the rand gold price,mechanically reducing nearterm revenue per ounce expectations for South African producers. Thin holiday trading conditions may have amplified day-to-day swings. The move also comes against an existing sensitivity to Harmony’s rising cost and capital spending outlook flagged previously, which can magnify downside when bullion momentum cools.

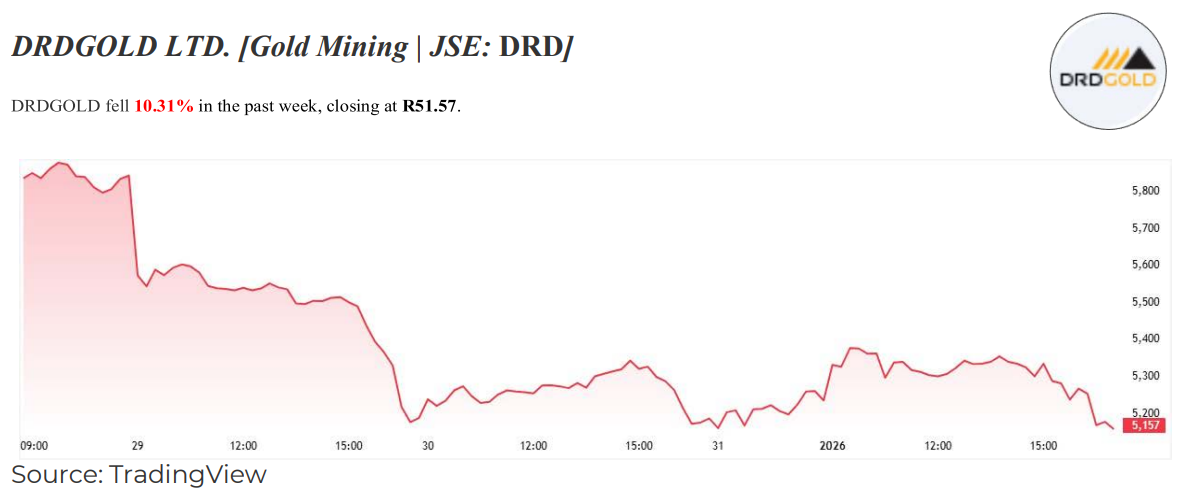

DRDGOLD’s decline was similarly driven by macro factors: a pause in the precious-metals rally alongside a comparatively firm rand likely lowered the rand gold price, which DRDGOLD’s tailings-recovery model is highly leveraged to. After a year of repeated gold highs, profit-taking can be sharp, particularly in thin holiday liquidity. Stock-specific risk may also have contributed to a higher perceived risk premium after December labour tension at its ERGO operations, even though the planned strike action was later suspended.

Key Industry Movements

At-a-Glance Takeaways

• ↓ Mining: Commodity pullbacks and thin liquidity weighed on sentiment.

• ↑ Financials: Lower bond yields provided limited support.

• ↑ Food Producers: Favourable weather and easing costs supported defensives.

• ↑ Real Estate: Softer bond yields underpinned property demand.

Mining | FTSE/JSE Mining Index [J177]

FTSE/JSE Mining Index [J177] closed Friday at 141,928.80, down 4.44% from Monday’s open. Weakness was driven by sharp pullbacks in precious metals, with platinum and palladium retreating on profit-taking after recent highs. Softer iron ore prices, linked to improved global supply conditions, added pressure to diversified miners. Thin year-end liquidity likely amplified commodity-driven moves. The decline indicates reduced appetite for cyclical exposure, with near-term sentiment still highly dependent on commodity price direction and signals around Chinese demand.

Financials | FTSE/JSE SA Financials Index [J580]

FTSE/JSE SA Financials Index [J580] settled at 61,289.59 on Friday, up 0.51% from Monday’s open. Support came from slightly lower long-dated bond yields, which improved valuation conditions and signalled a more stable funding environment. Limited news flow and a calmer global backdrop also helped contain volatility. However, gains were restrained as investors weighed improved credit conditions against potential margin pressure if rate expectations ease further. The move reflects cautious confidence ahead of key inflation and fiscal developments.

Agriculture | FTSE/JSE Food Producers Index [J357]

FTSE/JSE Food Producers Index [J357] closed Friday at 10,076.46, up 0.87% from Monday’s open. Positive momentum reflected favourable local weather conditions supporting crop prospects, alongside stable global grain supply. Signs of easing input costs, including fertilisers, also underpinnedmargin expectations.With little company-specific news, the sector’s defensive earnings profile attracted interest. Performance suggests resilience, although outlook remains sensitive to weather outcomes and global food price trends.

Real Estate | FTSE/JSE All-Property Index [J803]

FTSE/JSE All-Property Index [J803] closed Friday at 12,060.98, up 1.02% from Monday’s open. Gains were supported by lower bond yields, which improved the appeal of property yields and eased discount rate pressure. Improved sentiment in the local bond market outweighed the lack of sector-specific news during the holiday period. While investor appetite for yield remains evident, performance continues to hinge on bond market stability, refinancing conditions, and domestic growth expectations.

INTERNATIONAL NEWS AFFECTING SOUTH AFRICA

The week was dominated by a sharp escalation in geopolitical risk alongside shifting global growth and interest rate signals, creating a more volatile backdrop for energy markets and cross border capital flows relevant to South Africa.

Venezuela escalation disrupts oil flows and lifts geopolitical risk

Escalation in Venezuela sharpened geopolitical risk after a United States operation detained President Nicolás Maduro on 3 January, following weeks of stepped-up sanctions enforcement against oil traders and tankers linked to PDVSA. The United States Treasury sanctioned four companies and identified four oil tankers as blocked property on 31 December, intensifying a campaign that has constrained shipping and reduced export activity. Port captains were not authorising loaded ships to depart in early January, leaving crude cargoes stranded even as oil facilities appeared largelyunscathed. For South Africa, the episode may sustain a risk premium in oil prices and raise uncertainty around fuel inflation, while a broader risk-off turn can weigh on demand for emerging-market bonds and equities.

United States rate-cut path looks less certain

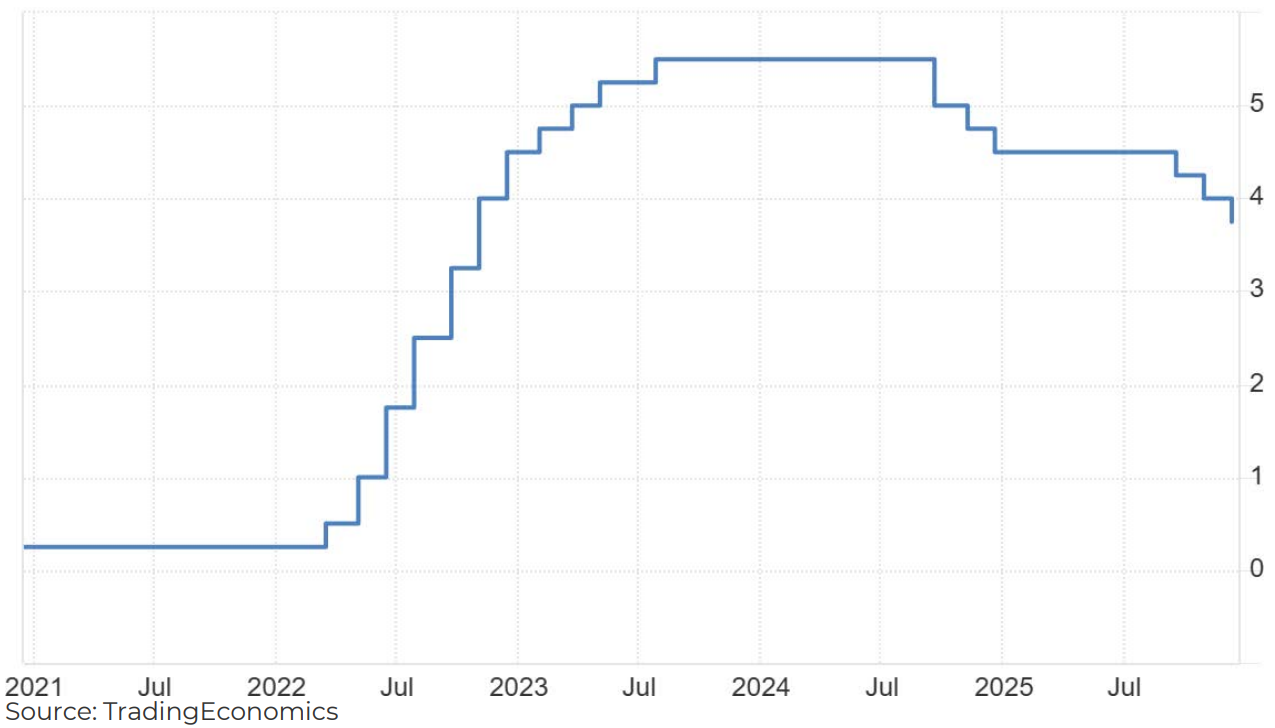

Federal Reserve officials signalled a more patient approach to further easing after last year’s rate reductions, with Philadelphia Fed President Anna Paulson saying another cut could take time as policymakers assess whether inflation continues to cool and whether the labour market is merely slowing or weakening more materially. The policy rate remains at 3.5% to 3.75%, which the Fed still views as slightly restrictive. Markets also stayed focused on US fiscal policy and Treasury supply dynamics, after a year in which political pressure on monetary policy remained a live issue. If expectations shift towards fewer or later cuts, global bond yields can stay higher for longer, which may raise South Africa’s external funding costs and keep risk appetite more selective.

United States Fed Funds Interest Rate (%)

China’s factories return to marginal growth

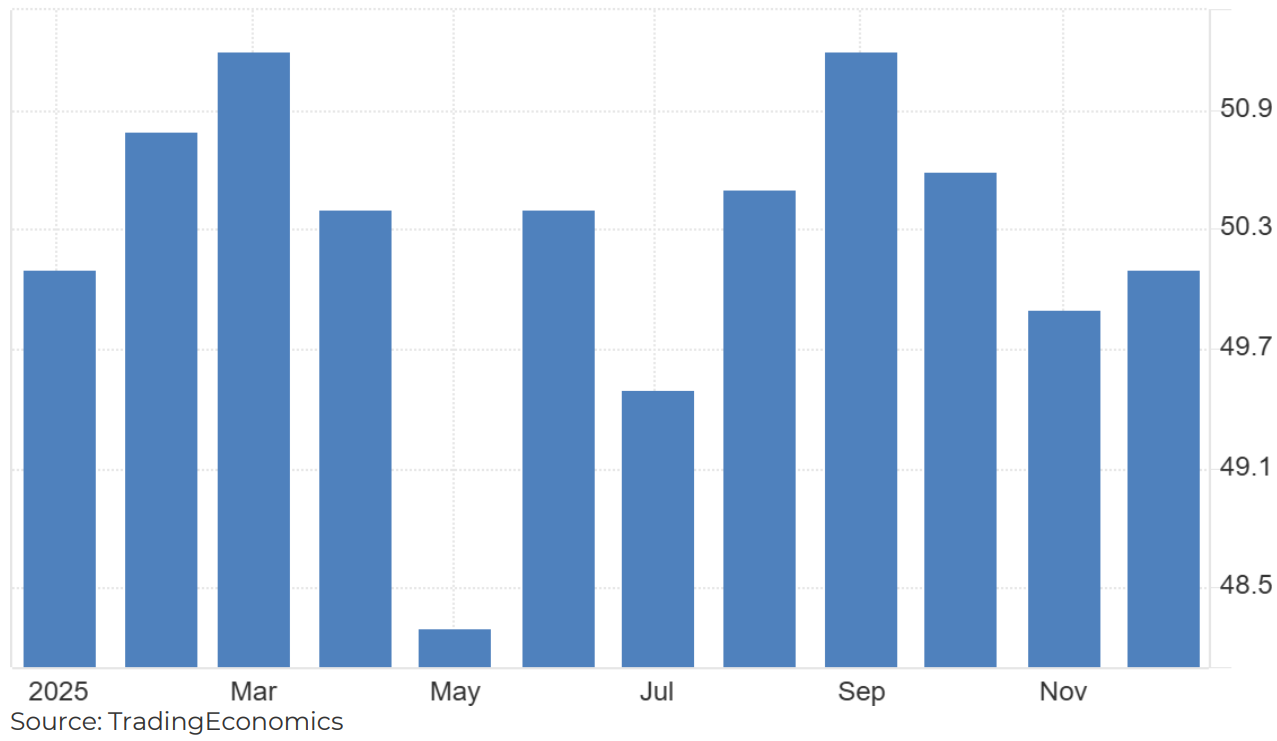

China’s factory activity edged back into expansion at year end, with a private manufacturing survey rising to 50.1 in December from 49.9 in November, broadly matching the official reading and suggesting domestic demand stabilised even as export orders softened. The survey pointed to improving output and new domestic orders, but noted continuing price pressure, including higher input costs for some metals, and further job shedding as firms restructured. The data reinforced a picture of growth meeting official targets while confidence remained cautious amid trade tensions and a still-fragile property sector. A steadier Chinese cycle generally supports demand expectations for South Africa’s bulk commodities and industrial metals, while weaker export momentum can temper upside for the most cyclical miners.

China RatingDog Manufacturing PMI (Points)

Eurozone industrial slowdown deepens into year-end

Eurozone manufacturing remained in contraction at year end, with factory activity weakening further across the bloc and raising concerns about spillovers into services and employment in early 2026. With inflation near target, the data sharpened the policy balance facing the European Central Bank between supporting growth and keeping conditions restrictive. Weaker European demand may weigh on South African exporters and dampen global risk sentiment affecting emerging-market flows.

OPEC+ signals steady course as oil starts 2026 under pressure

Oil prices remained under pressure at the start of 2026 after posting their largest annual decline since 2020, with OPEC+ signalling a likely extension of current output limits into the first quarter. Elevated inventories and weak demand growth continued to cap prices despite ongoing geopolitical frictions among some producers. For South Africa, a period of lower oil prices may ease fuel-related inflation pressures and support consumers, although continued volatility can still influence broader risk sentiment and interest-rate sensitive markets.

SOURCES INCLUDED BUT NOT LIMITED TO

This report is published by Everest Wealth for general information and educational purposes only and does not constitute financial advice as defined by the Financial Advisory and Intermediary Services Act, 2002 (FAIS Act). The content is based on market research conducted around the reporting date. Figures and insights may change due to market conditions. Please note that past performance is not indicative of future results. Please consult with a licensed Financial Advisor to determine if such investments are appropriate for your individual circumstances.

Everest Wealth Management (Pty) Ltd is an authorised Financial Services Provider (FSP 795) and a registered credit provider NCRCP 21504